Parler

Parler Gab

Gab

Price hike could be meant to curb demand as Saudis struggle to increase production

Saudi Arabia raised prices a day after it joined the monthly OPEC+ meeting wherein the group met to discuss its oil production plans for September. The group of the world's largest oil exporters ultimately decided to raise their September quota by 100,000 barrels per day (bpd). Saudi Arabia was allocated an additional 26,000 bpd. OPEC increasing its daily oil production plans for September strongly suggests that the group believes oil demand will increase next month. However, Saudi Arabia increasing the price of its crude is sending a different message: that it wants to cool the demand for its exports, especially to its Asian clients, by hiking prices. Many major oil producers around the world are still facing supply problems. According to analysts at Goldman Sachs Group, demand exceeds output by around two million barrels a day. This, coupled with Asian oil consumption continuing to recover since its 2020 slump, could mean that Saudi Aramco is facing similar concerns with meeting demand. "Look at demand outside the U.S. – India is scorching. China, we think, is growing strongly," said Bob McNally, president of Rapidan Energy Advisers, during an appearance on Bloomberg Television. Saudi Arabia sells most of its oil to Asian clients, especially in China, India, South Korea and Japan. Learn more about the oil and energy situation around the world at NewEnergyReport.com. Watch this episode of the "health Ranger Report" as Mike Adams, the Health Ranger, discusses how America is already running out of diesel engine oil products. This video is from the Health Ranger Report channel on Brighteon.com.More related stories:

Oil-producing giants warn of dwindling energy supply worldwide as fuel prices hit record highs. Saudi Arabia says it can't ensure oil supply stability amid "jittery period" of global instability. Saudis consider using yuan over dollar in oil sales; move could signal collapse of petrodollar and the American economy. Saudi Arabia may increase oil prices amid Russia-Ukraine war. Sources include: Finance.Yahoo.com OilPrice.com Reuters.com Brighteon.comWH argues current recession isn’t ‘technically’ a recession, ‘it feels unique, because it is unique’

By News Editors // Share

Water in Germany’s Rhine River in critical level; waterway may soon be impassable

By Belle Carter // Share

Biden’s “zero percent inflation” only increases America’s suffering

By News Editors // Share

Walmart continues to lose customers as inflation forces Americans to turn to dollar stores

By Arsenio Toledo // Share

Nearly 300 million ounces of physical silver have been drained from the market

By Arsenio Toledo // Share

Debunking McGill's "dirty dozen" hit piece: Flawed sources, pharma ties, and biased reporting

By newseditors // Share

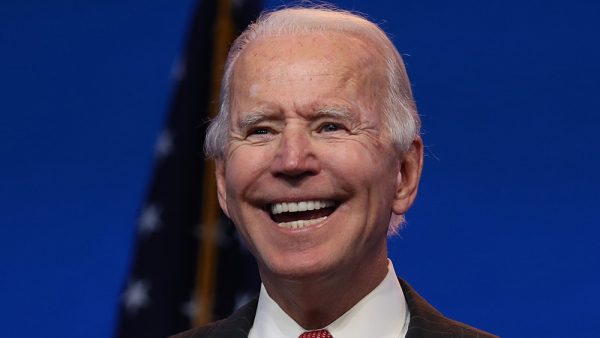

Your lyin' eyes: Corporate media panics with 'fact checks' over Biden's obvious decline

By newseditors // Share