Parler

Parler Gab

Gab

- PJM Interconnection’s capacity auction hits record 16.1B, with capacity costs surging to 329.17 per megawatt daily.

- AI data centers, such as Virginia’s “Data Center Alley,” drive historic demand spikes, outpacing grid infrastructure.

- Price caps curb prior volatility, but consumers still face sharply rising bills amid insufficient new power supplies.

- Natural gas plant investments hit $34B, signaling industry reliance on fossil fuels to meet demands.

- Politicians and advocates clash over balancing investor profits, energy equity, and decarbonization goals.

The AI footprint: How data centers outgrow grid capacity

Data centers now rival cities in power consumption. In the latest auction, PJM confirmed that new facilities — many fueled by the AI boom — are siphoning massive volumes of electricity, mirroring the growth of towns like Alexandria, Virginia. Jon Gordon, policy director at Advanced Energy United, noted that the demand has forced grids into a “tug-of-war between near-instant server builds and obsolete infrastructure.” The math is stark: While U.S. energy capacity additions have slowed to a crawl, data center construction has skyrocketed. Verizon’s AI Connect offerings alone saw sales double to $2 billion this quarter, supporting edge computing and real-time AI inferencing. “This isn’t just demand — it’s a metastasis,” said electricity trader Greg Lim, with servers now demanding 24/7 baseline power that strains even backup systems.Grid aging and investment gaps fuel vulnerabilities

The crisis deepens as power plants shut faster than replacements arrive. Over 90% of retiring capacity in the PJM region since 2020 has been fossil-fueled, and renewables like wind and solar lag behind needed scalability, lacking storage to provide round-the-clock “baseload” power. Joe Bowring, president of Monitoring Analytics, the grid’s watchdog, bluntly stated: “There is simply no new capacity to meet new loads.” Bowring argues that without mandates for developers to bring their own generation — via on-site renewables or partnerships — a cycle of supply shortages will persist. The result? Utilities are leaning on natural gas. Firms like NRG and Talen Energy spent $34 billion in 2025 acquiring aging gas plants to meet demand. Barclays analyst Nick Campenella called this a “win” for shareholders but warned of “regulatory backlash” as politicians decry fossil fuel dependence.Political firestorms and the price cap tango

The 2024 auction, which saw capacity prices spike 600% overnight, sparked a backlash that led to a 2025 settlement with Pennsylvania Governor Josh Shapiro. The deal imposed price floors (177.24/MW) and ceilings (329.17/MW), preventing repeats of the previous year’s shock. This year’s results hit exactly the cap, quelling volatility but locking in record pricing. Yet consumers are still scrambling. Exelon’s customers in Baltimore faced $466/MW costs last year — the ceiling now prevents such spikes — to some relief. But advocates argue the cap artificially suppresses market signals, delaying infrastructure fixes. “They’re kicking the can, not solving it,” said Sharon Mastrangeli of the National Consumer Law Center.The crossroads between innovation and equity

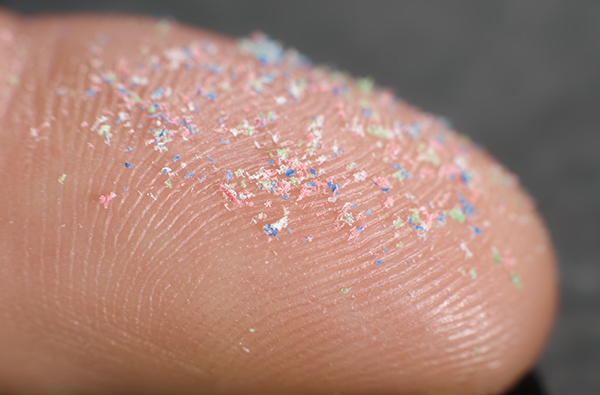

The PJM auction underscores a national quandary: How to power exponential AI growth while ensuring the energy transition doesn’t become a cost explosion. Renewable solutions like solar farms in Texas or offshore wind in the Northeast face permitting delays and “not in my backyard” resistance. Meanwhile, quick fixes like gas plants perpetuate carbon emissions, clashing with decarbonization pledges. As data centers fork over billions for power, the question for policymakers is clear: Can they incentivize storage and clean baseload solutions without turning energy equity into a relic? Or will 2025’s record prices foreshadow a future where innovation’s price tag lights a fuse for political revolt? One reality is certain: Even if you avoid AI-driven gadgets, the grid is suddenly much hotter — and no one will feel the heat more than ratepayers. Sources for this article include: ZeroHedge.com Bloomberg.com AInvest.comThe silent invasion: How microplastics are poisoning the human body

By Ava Grace // Share

Trump to Iran: Restarting uranium enrichment could trigger more airstrikes

By Zoey Sky // Share

By News Editors // Share

U.K. regulator pressured U.S. tech firms to enforce British speech laws, leaked emails reveal

By Laura Harris // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share