Parler

Parler Gab

Gab

Is silver undervalued, or is it all a ploy?

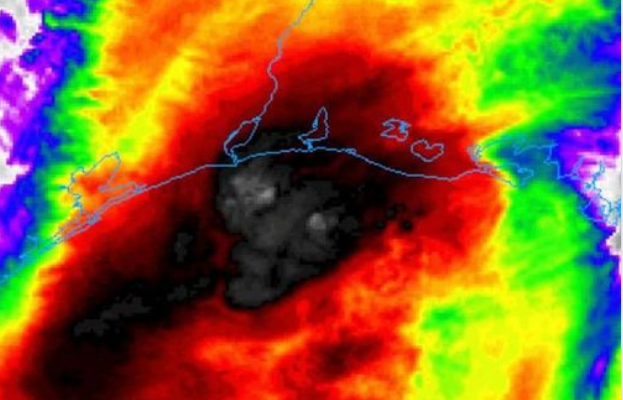

The media would have us all believe that this silver rush is an organic phenomenon driven by a widespread belief that the metal is currently undervalued. This would certainly seem to be the case based on current demand, after all. There is also the new January jobs report, which some say is driving confidence that metals are a good bet for the everyday investor. "The U.S. employment situation report for January, arguably the most important U.S. data point of the month, showed a non-farm payrolls rise of 49,000 and an unemployment rate of 6.3%," writes Jim Wyckoff for Kitco News. "The non-farm jobs number was very close to market expectations and the unemployment rate was a bit lower than expected. Still, the data suggests the world's largest economy is still far from fully recovered from the Covid-19 pandemic and is still down 12 million jobs from last year at this time." Still, others are concerned that something more sinister is afoot, especially since the metals rush came about right at the time when wealthy hedge funds and their media lackeys launched their illicit crusade against the GameStop phenomenon. All eyes were distracted away from that short squeeze into a new one, or so we were told, centered around silver. They blatantly lied about the silver rush coming from Reddit, so the question remains: What, exactly, are they trying to do here by pushing the public into buying silver? "Wall Street loves unloading its silver long on you," wrote one Zero Hedge commenter. "Dollar short squeeze coming." "The entire silver thing was mostly a rumor that the media ran with," wrote another. "The WSB (WallStreetBets) guys were saying otherwise, and sticking with GME (GameStop). But that rumor led to physical and premium spikes. Paper went down." Another jibed that the establishment knew full well that the price of silver would be hammered back down almost immediately after its very mild "spike," but that most people will not even think twice about it as they cover their faces with two masks and continue starving their brains of oxygen. Sources for this article include: ZeroHedge.com NaturalNews.com Kitco.com NaturalNews.comThey are screwing with the weather maps: SUN is BAD!

By News Editors // Share

Deborah Birx hid covid info from Trump, altered CDC guidelines without approval

By Ethan Huff // Share

Americans actively avoid news due to untrustworthiness and bias of mainstream media

By Mary Villareal // Share

The mighty Eggplant: An underrated superfood with ancient roots

By avagrace // Share

Trump administration reportedly preparing for military strikes on Iran, raising fears of escalation

By finnheartley // Share

The cancer fear industry: How big pharma profits from panic—and what natural alternatives offer

By finnheartley // Share

Try these six natural remedies to help combat seasonal allergies

By ljdevon // Share