Parler

Parler Gab

Gab

They're just rearranging the deck chairs while the ship sinks

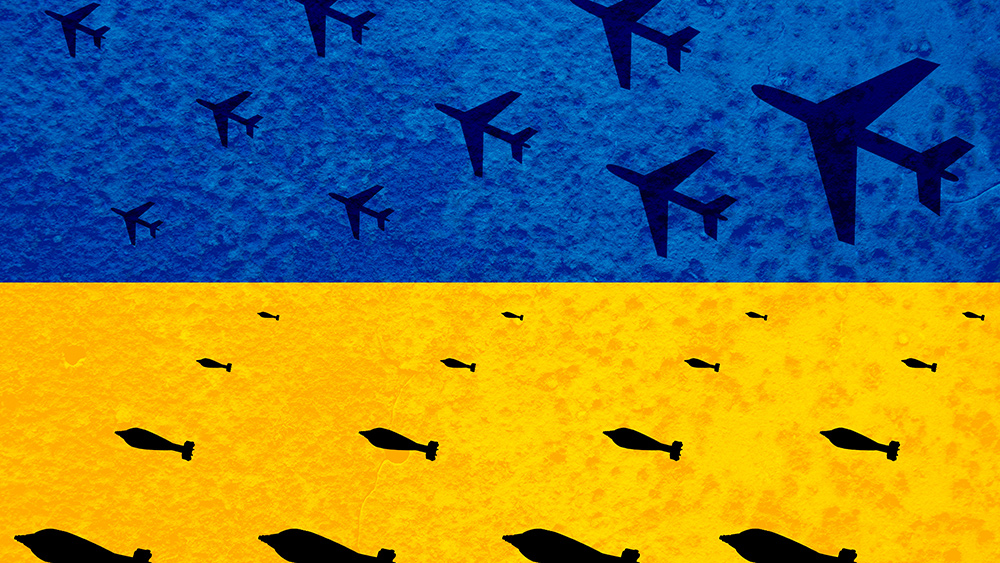

The stated goal of the purchase is to keep the lights on in Germany as the country faces a very dark winter in a few months due to its own policies against Russia. "This step has become necessary because the situation has worsened significantly," announced Robert Habeck, Germany's economic minister. "The state will do everything necessary to keep systemically important companies in Germany stable at all times." Since the beginning of the year, Uniper's share price is down 93 percent. Back in July, Berlin injected $14.95 billion into the company in an attempt to save the utility from a total collapse. Here is what Fortum president and CEO Markus Rauramo had to say about the deal: "Under the current circumstances in the European energy markets and recognising the severity of Uniper's situation, the divestment of Uniper is the right step to take, not only for Uniper but also for Fortum." "The role of gas in Europe has fundamentally changed since Russia attacked Ukraine, and so has the outlook for a gas-heavy portfolio. As a result, the business case for an integrated group is no longer viable." Uniper CEO Klaus-Dieter Maubach also chimed in about the matter, stating that the nationalization of his company "secures the energy supply for companies, municipal utilities, and consumers." In order to avoid another "Lehman-style" collapse of the entire energy industry, Germany is expected to bail out and nationalize other utilizes across the country. We are told that Germany might make it through part of the winter, anyway, as it claims to have secured approximately 90 percent of its needed natural gas supply for the season. But this is not enough. "These supplies only cover two months, and without increased imports of liquefied natural gas from afar, it could only suggest a dark winter for Europe," says Zero Hedge. In the comment section, someone pointed out that the collapse has clearly already begun. The powers that be are simply rearranging the deck chairs on the sinking ship to establish "who will be the winners and losers, i.e., too big to fail." "The government will own all the energy," added another. "Next they'll offer GovCoin, and if you don't stay in line, they'll shut off your energy." Since Germany uses fake fiat money printed by the European Union's private central bank just like the United States does via the Federal Reserve, all these bailouts are just "monopoly money" anyway, wrote another commenter. "They just throw it out and print more," this person added. The latest news about the European energy crisis can be found at FuelSupply.news. Sources for this article include: NaturalNews.com ZeroHedge.comVideo shows Bill Gates admitting “clean energy” solving climate change is a SCAM

By Belle Carter // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share