Parler

Parler Gab

Gab

How much debt can America handle?

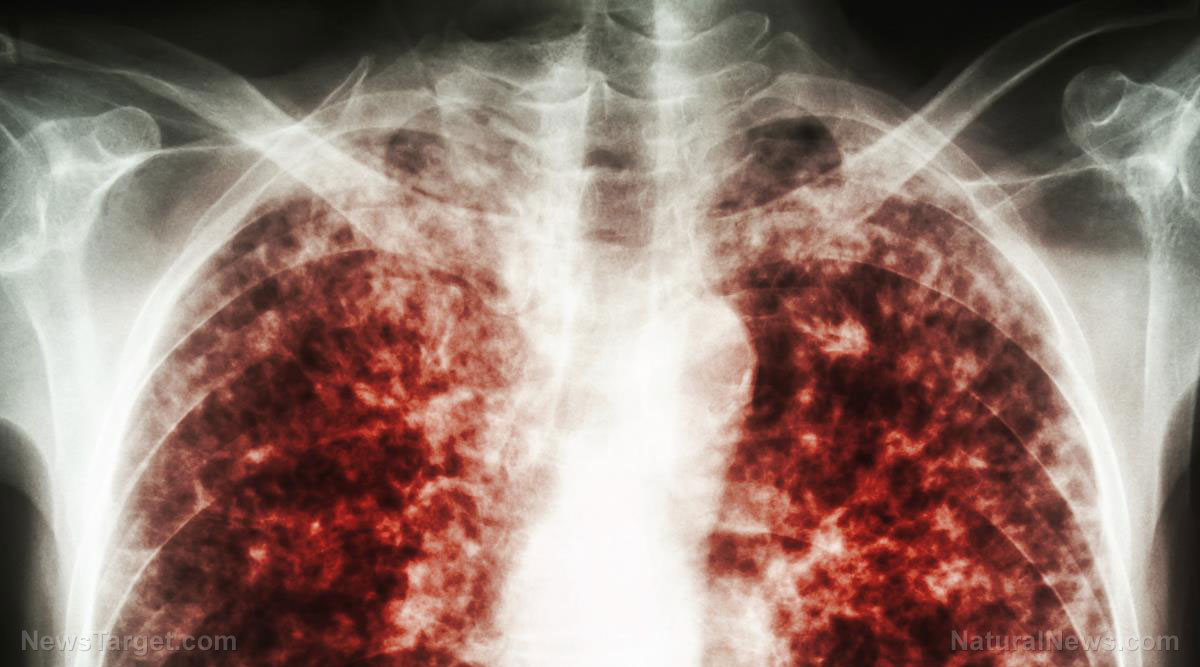

As always seems to be the case, the ruling political party, in this case the Democrats, forged a last-minute deal with Republicans late last year to increase the debt ceiling in order to avoid a default at least through January 2025. This default can-kicking action occurs fairly regularly as each new time the country gets close to the debt ceiling, the ruling uni-party votes in the 11th hour to up the debt ceiling. It was initially expected that reaching the $34 trillion mark in national debt would not occur for a few more years yet. Because of the Wuhan coronavirus (COVID-19) "pandemic," the $34 trillion threshold is said to have hit earlier than anticipated. At the end of 2022, the national debt grew to roughly 97 percent of gross domestic product (GDP). Under existing law, that figure is expected to balloon to 181 percent by the end of 2053, reaching a debt level that will far exceed anything previously seen. "Though our level of debt is dangerous for both our economy and for national security, America just cannot stop borrowing," said Maya MacGuineas, president of the Committee for a Responsible Federal Budget (CRFB). The Biden White House is blaming Republicans for the astronomical rise in federal debt. "This is the trickle-down debt – driven overwhelmingly by repeated Republican giveaways skewed to big corporations and the wealthy," commented Michael Kikukawa, White House assistant press secretary, in a statement to FOX Business. With interest rates on the rise, the cost of servicing America's ever-rising national debt is also increasing. This has to do with the fact that as interest rates rise, the federal government's borrowing costs on its debt also increase in proportion. Over the next three decades, interest payments on the national debt are projected to become the fastest-growing part of the federal budget, according to the CRFB. "Payments are expected to triple from nearly $475 billion in fiscal year 2022 to a stunning $1.4 trillion in 2032," FOX Business further reported. "By 2053, the interest payments are projected to surge to $5.4 trillion." How much longer will the U.S. financial system persist? Find out more at Collapse.news. Sources for this article include: Infowars.com NaturalNews.com FOXBusiness.comCoverup of tuberculosis outbreak at Cape Cod migrant encampment EXPOSED by local media

By Laura Harris // Share

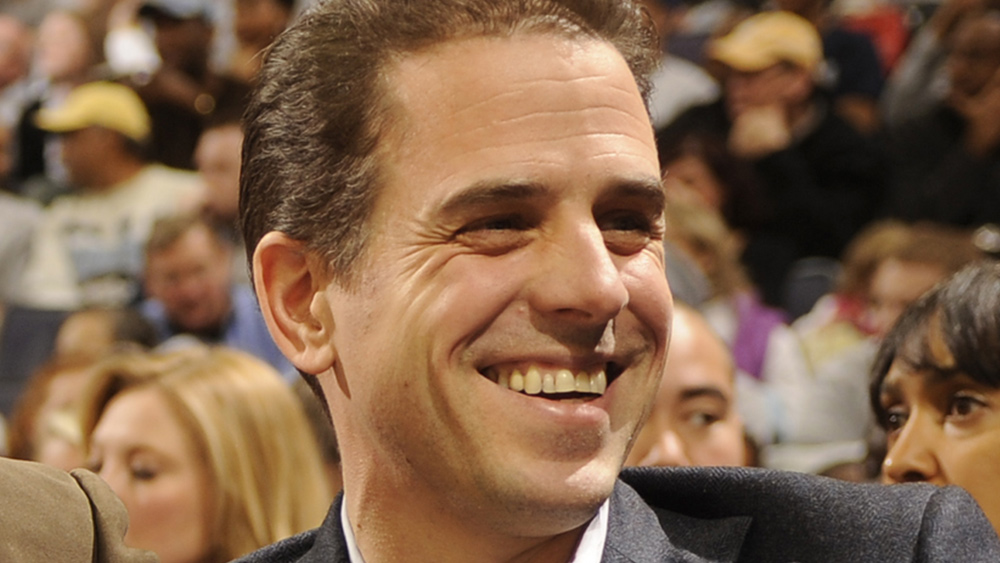

Hunter Biden WALKS OUT of House hearing as Republicans rebuke presidential son

By Ramon Tomey // Share

ICJ begins hearings on South Africa’s genocide case against Israel

By Arsenio Toledo // Share

West steps up activities in Red Sea as Iran warns against U.S. adventurism

By Richard Brown // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share